The chase sapphire reserve and the citi prestige cards both offer superior benefits such as annual travel credits airport lounge access and the ability to transfer points to airline and hotel loyalty partners.

Citi premier vs chase sapphire preferred reddit.

With the sapphire preferred you ll earn chase ultimate rewards points while the citi premier earns citi thankyou points.

The sapphire reserve has a broad definition of what constitutes travel including many of your everyday expenses such as public transit and taxis.

The sapphire preferred is a big winner with an additional 20 000.

The chase sapphire preferred is offering a welcome bonus of 80 000 ultimate rewards points after spending 4 000 on purchases within the first three months.

But which one is best suited to your particular travel goals lifestyle and spending habits.

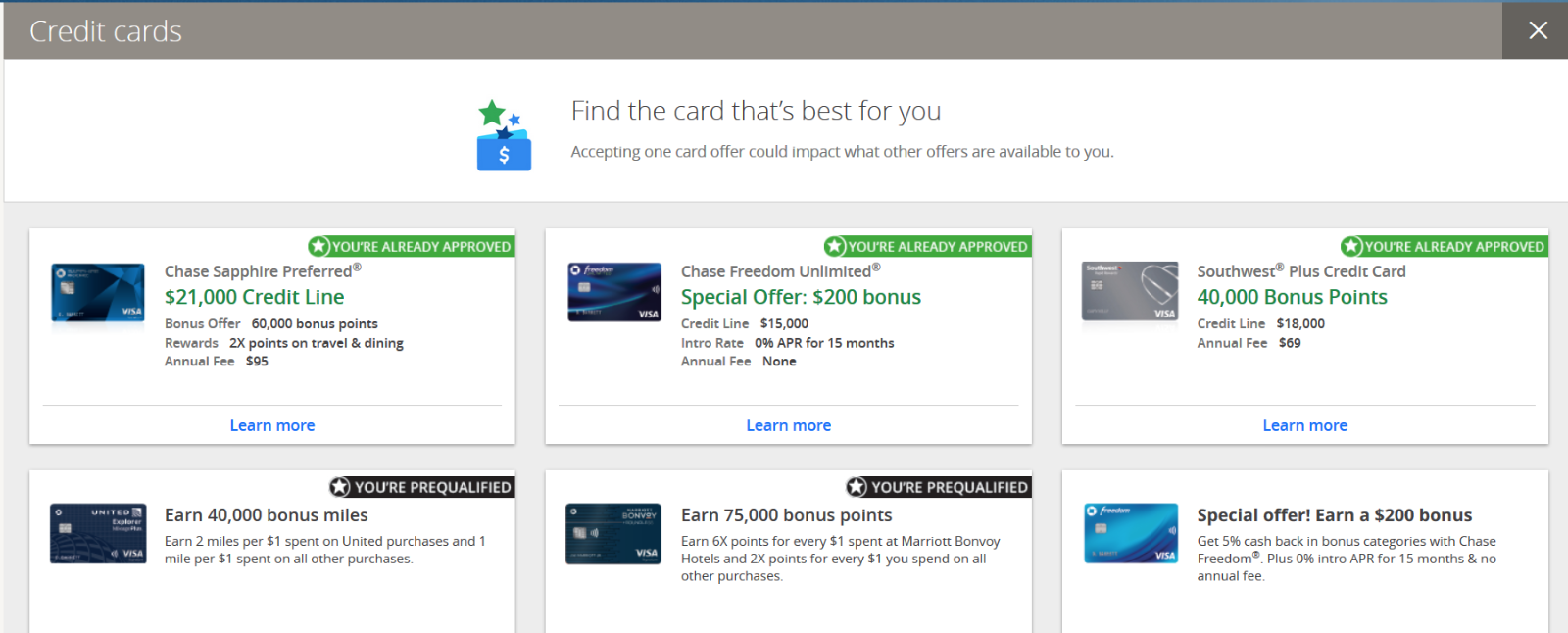

Read our comparison chart below.

The citi premier and chase sapphire preferred are the clear leaders when it comes to affordable entry level cards that earn valuable transferable bank points.

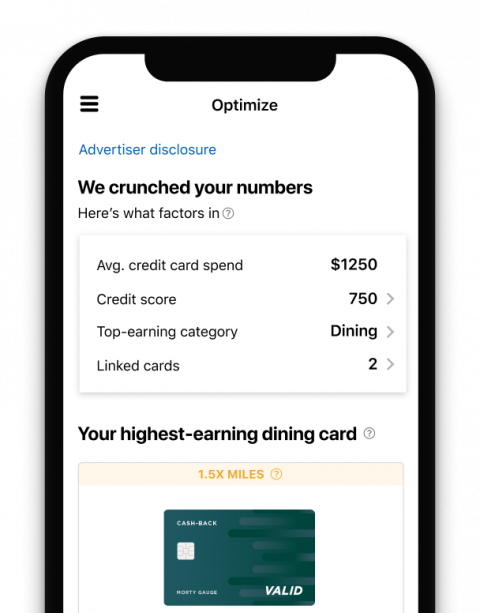

So effectively points are worth 1 25 cents apiece if you use them with chase.

Chase sapphire preferred vs costco citi visa credit card which one is better.

How does it compare to citi aadvantage an airline credit card.

The sapphire preferred doesn t offer a bonus on gas like the citi premier but it does offer a 25 percent value boost when you redeem points through chase ultimate rewards for travel.

The chase sapphire reserve comes in second with 3x earning on all travel and dining purchases and the recent addition of a 10x bonus category for lyft rides.

The chase sapphire preferred card and the citi premier card have a lot in common.

Chase sapphire preferred is a high earning rewards card for those with excellent credit.

Reviews this is a close one as far as both our editors and our users are concerned.

Each card wins in different categories in our analysis so the best card for you will depend on 1 the other cards currently in your wallet and 2 which benefits you value most.

Keep in mind the chase sapphire preferred has a 95 annual fee while the citi aadvantage has a 99 annual fee waived for first 12 months.

Answering that question involves drilling.

The citi premier is offering a welcome bonus of 60 000 thankyou points after spending 4 000 on purchases within the first three months.

Hi all i just wanted to see if anyone out there has experience with both the chase sapphire preferred a travel card and costco citi visa a cash back card credit cards and which one is better specifically for travel and dinning.

Chase sapphire preferred vs.

Our editors felt that chase sapphire preferred is a slightly better option overall awarding it 4 5 out of 5 stars and giving citi premier 3 7 stars in their respective full length reviews.